Why Choose Capri Loans?

Flexi-payment options

Adjustable repayment options depending on your timeline

Quick Disbursals

Fast and seamless loan disbursement for you.

Choose what you need

A wide variety of loan types to choose from.

Convenience

Increase your loan amount according to your needs.

Flexi-payment options

Adjustable repayment options depending on your timeline

Quick Disbursals

Fast and seamless loan disbursement for you.

Choose what you need

A wide variety of loan types to choose from.

Convenience

Increase your loan amount according to your needs.

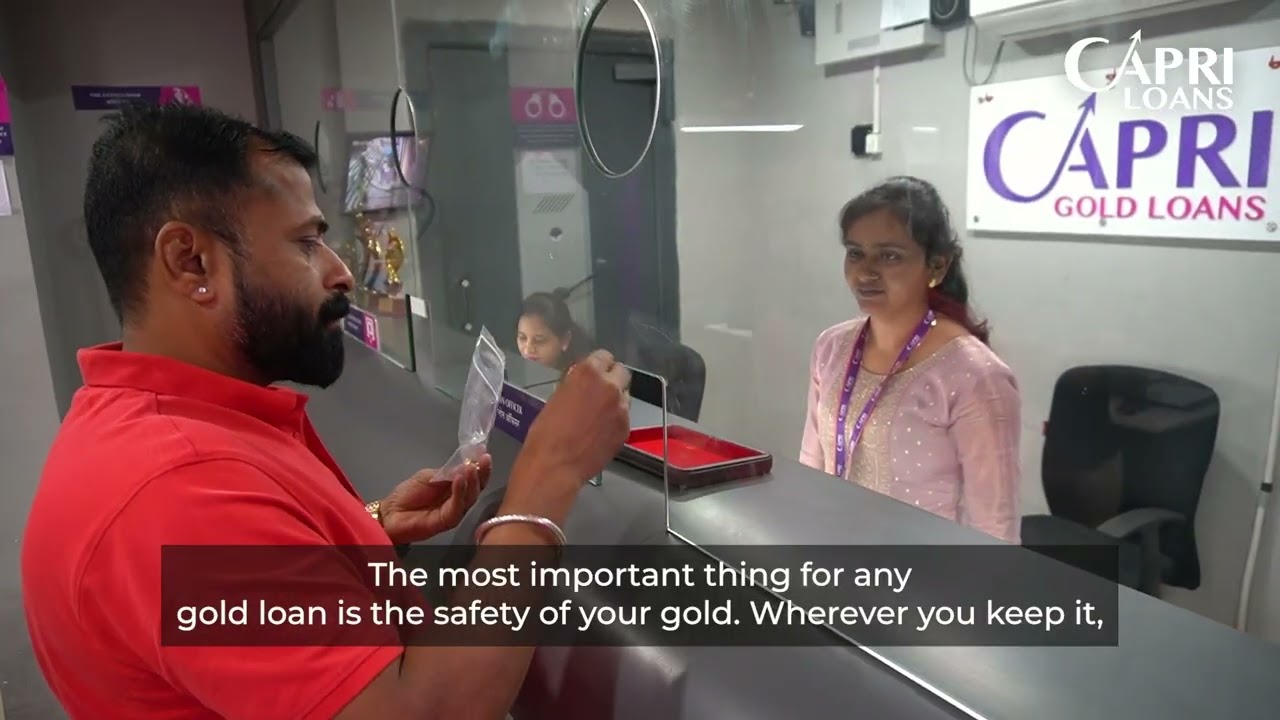

Why Choose Capri Loans?

See what our customers say

Akhilesh runs a local kirana store. See how he was able to break free from the hassles of renting a house and store to getting his own home constructed. Capri Loans helped Akhilesh to own and expand his business on a new plot and generate higher savings in the long run.

Akhilesh Kumar , Business

Business Loan